Quick free £10 with park referral offer, but should you save with them?

Up until recently every single year a big proportion of Christmas shopping would go on credit cards or Klarna etc, left to pay off with December and January pay days. I’ve always intended to save up and have the money ready for Christmas but never did.

For 2023 a lesson will be learned. So I have decided to consider saving up money each month one option for this is by making a small Direct Debit into the Park Christmas Savings account which will give me a wealth of vouchers at the end of the year to buy all the prezzies with. You can also get £10 free if sign up with Park as well, but is it the best way to save for Christmas?

What is Park?

Park has been around for over 50 years, has come a long way from the yearly saving plan for food hampers. But the principal is the same, invite people to save for Christmas throughout the year so that when it comes to crunch time, familiess have the money to have the Christmas they want. Park currently does this for about 400,000 families every year.

How to claim £10 free with Park referral offer

You can get £10 free if you sign up with a referral link, which kicks in once you get £25 saved up, a nice little top up to the Christmas fund. Here’s mine: LINK

- Sign up with a referral link

- Set up your account

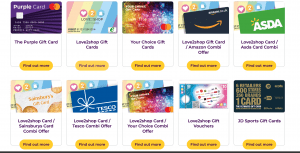

- Pick which gift cards/vouchers you would like. There are lots to choose from (I went Love to Shop as it covers most of shop choices)

- Choose how you will pay for your Christmas savings:direct debit / debit/credit card etc

- Receive your £10 bonus* into your account once you have paid £25 into your account.

- Refer your friends to get a £10 bonus for each that sets up an account and funds it with £25.

What can you redeem your money for on Park?

You can redeem your money for a whole host of instant vouchers, including love 2 shop which means you can use them in the vast majority of places, such as Amazon vouchers, supermarket vouchers, Argos, Asos etc.

Why Park? Good idea or bad idea?

So is Park the best way to save for Christmas, are there any risks, well there are certainly things to consider.

Bad idea?

To be honest you could buy vouchers at a discount at a whole host of other places, like Jam Doughnut for example offers 4.8% on Argos gift cards (Referral code for 200 points free (UY1E), so Park may not be the best value as you are paying full price in effect.

But if you know you will spend a certain amount at these stores at least you won’t lose anything. Plus with the initial £10 free it is a good incentive which, if you share with your friends you can get an additional £10 for each friend that signs up.

Also your money is not protected by the FSCS, so if the company goes under then you could lose all your money without any protection.

Another potential downside is that unlike if your cash was in an instant saving account, which can still be accessed with ease and be potentially earning interest.

So if you didn’t use Park but instead saved the money yourself you could earn interest on the money and also be able to get discounts on the gift cards that you would have got with park. Doesn’t look too inviting does it.

Good idea?

Well there is obviously the fact that you get £10 free, a nice little bonus.

But I think the biggest incentive for the people using Park, is keeping the money in the ‘Christmas club’ as we all have the best intentions, but they are not easily followed so this ensures you have the cash at hand to go berserk at Christmas time and prevent that credit card getting topped up instead!

Maybe not FSCS but there is some protection that was explained in this money saving expert article

“The association was set up after the Farepak debacle and has a voluntary code of practice, which says customers’ money must be held in a separate trust (Farepak customers’ cash wasn’t). At least half of the trustees – the people appointed to oversee the account where customers’ cash is kept – must be independent of the Christmas savings club.

The CPA says this means you’re more likely to get your cash back if a savings club were to go under. However, there are still some occasions when the companies can take cash out of the trust to run the scheme, so there’s no absolute guarantee you’d get the full amount back”

Park has been around for a long old time as well so would say the chances of it going under are very low but who knows what will happen in the future.

Summary and what I’ll be doing

So weighing that up there is not a lot of great reasons to use Park but £10 free is £10 and if I were to just put in £25 I would be doing well and making a good return by getting £10 free, and potentially a lot more if my friends and family to sign up as well.

But always being the paranoid mess, I would be wary of putting too much in, just in case the unthinkable happened and the company went under. But I do see the appeal of forcing yourself to lock your money away until the end of the year. But if savvier, you could be earning more money and paying less. So go get your bonus £10 after putting £25 in, tell your friends and family to do the same, then set up your own e-saver, put money in there then buy discounted gift cards ….. sorted.

If you are always on the hunt for free money offers then check out the free money page for the best sign up offers that can get you some easy cash with very little work.